Budget Information

- 2023 Garden Foundation Financial Statements

- 2024 / 2023 Audited Financial Statements

- 2024/2025 Adopted Final Budget

- 2024/2025 Adopted Water Rates

- 2025/2026 Tentative Budget

- 2025/2026 Tentative Water Rates

Impact Fees

Procurement Notices

Procurement and other public notices can be seen on our Public Notices page.

Bond Ratings

The Bond Ratings show the financial stability of Jordan Valley Water and the risk level for investors. Jordan Valley Water's ratings are highlighted below.

S&P: AA+

Fitch: AA+

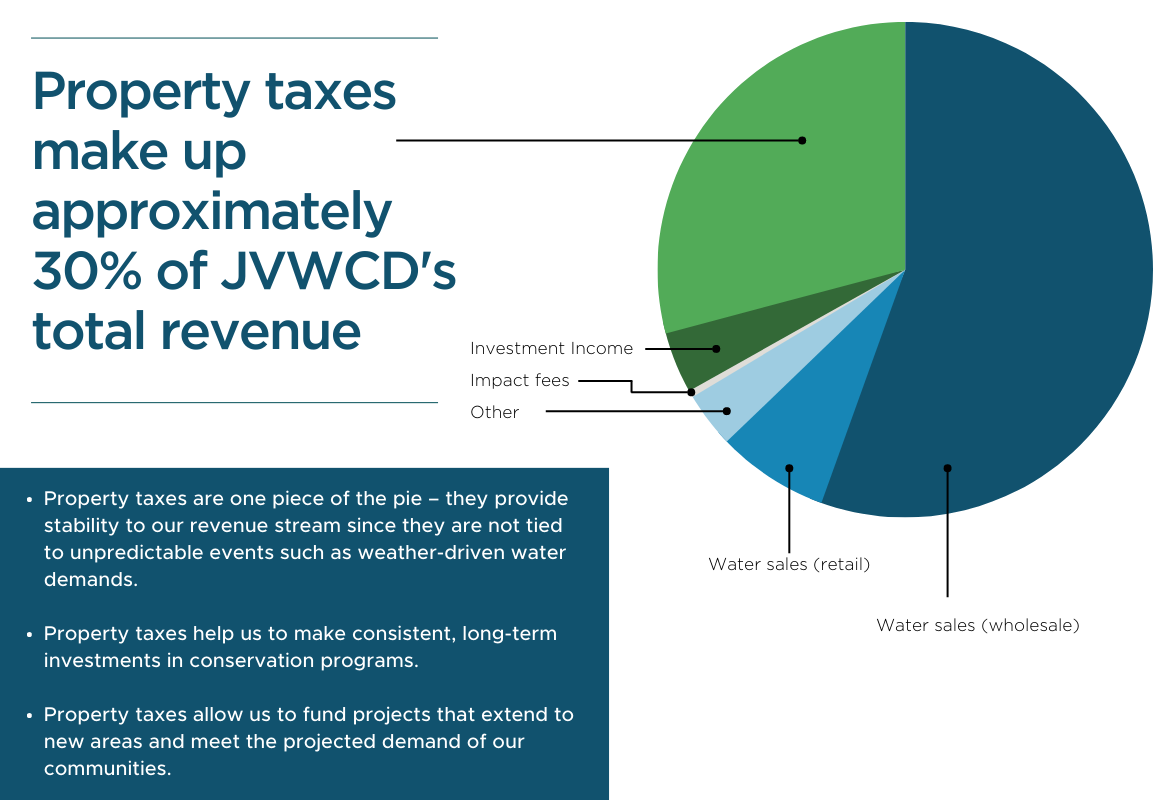

Property Taxes

Overview

Who is taxed by Jordan Valley Water Conservancy District?

Property owners within the boundaries of JVWCD are levied a tax based on property value including:

Where do my property taxes go?

Property tax revenues help fund the operations and capital projects necessary for providing water on a regional basis. They fund large water projects needed to develop water sources for population growth in JVWCD’s service area. Much of that growth will take 30-50 years to occur. Property taxes ensure that project costs are shared by current and future generations. Property taxes fund public benefits that extend beyond the water delivered to paying customers. Supplying clean, reliable water requires maintenance of facilities that are used for recreation and flood control (e.g. the reservoirs that store our supply). Additional public benefits include: